Understandably, you might be wondering how to keep an eye on fluctuating market trends and accurately pinpoint reversals. Fear not, as this article is here to guide you through the fascinating world of market analysis! Covering insightful strategies and tried-and-true techniques, it will enlighten you on identifying cyclical patterns, understanding key indicators, and utilizing efficient trading systems to forecast potential market reversals. All in all, the secrets to mastering the market’s ebb and flow are waiting for you right here, ready to lead you to a more informed and strategic investment journey. Let’s get started!

Understanding Market Trends

Making successful trades and investments heavily relies on your ability to understand market trends. A solid comprehension of these trends can provide insights into how the market is moving, and as a result, help you make informed decisions.

Definition of a Market Trend

In its simplest form, a market trend is the direction in which the market moves over a given time period. It’s a general course of action that an overwhelming number of market participants are involved in. Think of it as the ‘flow’ of the market that you, as an investor or trader, would ideally want to go with and not against.

Importance of Following Market Trends

The importance of following market trends cannot be overly emphasized. Recognizing trends provides you with a basis for your investment or trading decisions. When you understand the trend, you are better placed to predict whether the market is more likely to rise or fall, aiding in buy or sell decisions.

Types of market trends: Uptrend, Downtrend and Sideways Trend

There are three primary types of market trends:

- Uptrend: An uptrend describes a market that’s increasing in value, with prices showing a series of higher highs and higher lows.

- Downtrend: In contrast, a downtrend refers to the market depreciating in value, demonstrating lower highs and lower lows.

- Sideways trend: Lastly, a sideways trend, or a horizontal trend, arises when there is little movement up or down in the peaks and troughs of the market.

How to Identify Market Trends

Identifying market trends can be a critical aspect of trading and investment. Here’s how you do it:

Analyzing Price Action

Price action analysis involves studying historical price movements to anticipate future market behavior. This form of analysis can help determine a market’s trend and volatility – crucial information for Management of risk and decisions about where to apply your trading strategies.

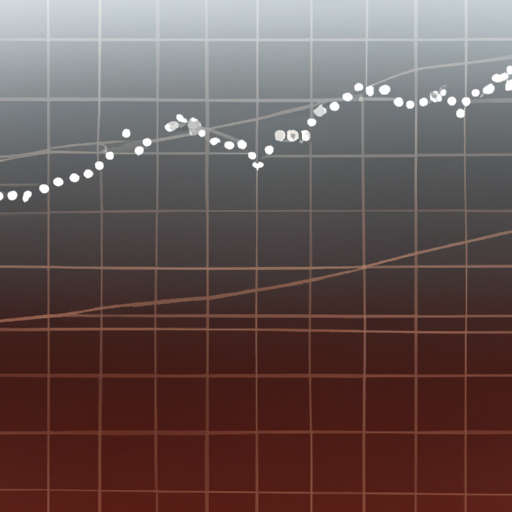

Using Moving Averages

Moving averages offer an objective measure of trend direction by smoothing price data. There are different types of moving averages, but all aim to provide a clearer view of price action by filtering out ‘noise’ from random price fluctuations.

Finding Support and Resistance Levels

Understanding support and resistance levels is key to identifying market trends. Support is a price level where a downturn is expected to pause due to a concentration of demand, and resistance being a price level where an uptrend is expected to pause due to a concentration of supply.

Technical Indicators for Tracking Market Trends

Technical indicators are a critical tool in tracking market trends. These indicators generally fall into two categories: leading indicators, which aim to predict price movements, and lagging indicators, that confirm a trend once established. Here are three prominent technical indicators.

Relative Strength Index(RSI)

Relative Strength Index (RSI) is a momentum oscillator that estimates the speed and change of price movements. It’s mainly used to identify overbought or oversold conditions in a market.

Moving Average Convergence Divergence (MACD)

MACD plots two lines: the difference between the 26-day and 12-day exponential moving averages, and a “signal line”, which is an exponential moving average of the difference. Whenever the MACD line crosses above or below the signal line, it signals a buy or sell opportunity respectively.

Bollinger Bands

Bollinger Bands are volatility bands placed above and below a moving average where the volatility is based on the standard deviation which changes as volatility increases or decreases. They adapt to changes in the market and can be used to identify potential tops and bottoms for market reversals.

Identifying Trend Reversal

A market trend doesn’t always progress in one direction; it reverses at times. Understanding trend reversals can be critical in taking timely action.

Definition of Market Reversal

A market reversal is just what it sounds like – a turn in the direction of a market trend. It usually occurs after an announcement or an event, signaling a substantial change in investors’ attitudes toward an asset.

Why Identifying Trend Reversal is Important

Identifying a trend reversal is crucial. It can help you understand when to exit or enter the market, and get ahead of significant market moves – both of which are key for maximizing returns.

Differences Between Market Reversal and Market Correction

While a market reversal indicates a change in the direction of the market trend, a market correction is a decline or an uptrend of 10% or more from a recent high in a market index or asset, suggesting a temporary pause in an upwards trend, not a closure to it.

Technical Indicators for Identifying Trend Reversals

Specific technical indicators can signal an impending trend reversal. Three of the most effective ones include:

Head And Shoulders Pattern

The head and shoulders pattern is a chart formation that appears as a baseline with three peaks, where the middle peak is the highest. This pattern is usually considered a reversal formation signaling that the market is likely to move against the previous trend.

Double Tops And Bottoms

A double top is a reversal pattern that is formed after there is an extended move up. The “tops” are peaks formed when the price hits a certain level but can’t break through to go higher. Conversely, a double bottom is formed after a long move down and signals a potential upward trend reversal.

Reversal Candlestick Patterns

Reversal candlestick patterns can be a powerful tool for spotting early signs of market reversals. Patterns such as doji, hammer, or engulfing patterns all indicate potential reversals.

How to Use Volume to Predict Market Trends and Reversals

Role of Volume in Stock Market

Volume plays a significant role in the stock market by displaying the number of shares or contracts of a security that are traded during a specific period. It’s an important indicator of the strength or weakness of a market trend.

How to Analyze Volume in Trading

When volume increases, it’s a sign that investors feel strongly about a price move, which means the trend is likely to continue. On the other hand, if prices are moving in a direction and volume is decreasing, it might suggest that the trend is about to end, indicating a possible reversal.

Volume-based Indicators

Volume-based indicators like the Volume-weighted Average Price (VWAP), the On-Balance Volume (OBV), or the Money Flow Index (MFI) can provide valuable insights as they take both price and volume into account, providing a more comprehensive picture.

Role of Economic Indicators in Tracking Market Trends

Interpreting Economic Reports

Economic reports on areas such as employment, economic growth, or consumer sentiment can give valuable insights on potential market trends.

Impact of Inflation, Interest Rates, GDP on Stock Market

Economic indicators like inflation, interest rates, or GDP can have a profound impact on the stock market. For example, increasing inflation or interest rates could lead to a decrease in stocks as they might suggest an economic slowdown.

Importance of Earnings Reports in Market Trends

Earnings reports, which indicate the profitability of a company, are another crucial factor. Positive earnings reports can lead to an uptrend, while negative reports could lead to a downtrend.

Utilizing Charts to Identify Market Trends and Reversals

Types of Stock Market Charts

There are three main types of stock market charts: the line, bar, and candlestick chart. Each provides a unique view into the market’s behaviour, helping traders identify trends or reversals.

Reading and Interpreting Candlestick Charts

Candlestick charts are particularly popular among traders because they display open, high, low, and closing prices. Practicing reading these charts can help you perceive trends and see potential reversals.

Spotting Trend Lines on Charts

Trend lines are lines drawn on a chart to help identify trends. An upward trend line is drawn at the lows of an upward trend. A downward trend line is drawn at the highs of the downward trend.

The Effect of Market Sentiment on Market Trends and Reversals

What is Market Sentiment

Market sentiment, also known as investor sentiment, refers to the overall attitude of investors toward a particular security or financial market. It is the tone or mood of the market, or the trends that investors feel are likely to occur.

How to Gauge Market Sentiment

Gauging market sentiment can be done in various ways, such as examining price movement and volume, studying psychological indicators, or conducting surveys.

Influence of News Events on Market Sentiment

Significant news events also can dramatically affect market sentiment, swinging it positive or negative, depending on the nature of the news.

Using Software and Tools for Tracking Market Trends and Identifying Reversals

Importance of Technology in Trading

Technology has become indispensable in trading and investing. It allows for sophisticated analysis, provides real-time data, and enables prompt execution of trades.

Types of Trading Software

There is a wide array of trading software out there, ranging from basic charting programs to complex platforms offering real-time streaming quotes, advanced order types, and the ability to monitor multiple markets.

Choosing the Right Tool for Market Analysis

Choosing the right software requires understanding your needs and assessing what software can meet those needs. Things you might want to consider include what markets you want to trade, what style of trading you wish to do, and what technical indicators you want to use.